Exchange Name | Pair | Price | 24h % | 24h High | 24h Low | 24h Vol |

|---|

CoinDCX | NEAR/INR | ₹ 97.292 | -5.05% | ₹ 102.468 | ₹ 96.161 | ₹ 1,94,103.08 |

Arthbit | NEAR/INR | ₹ 97.292 | -4.54% | ₹ 102.207 | ₹ 96.261 | ₹ 1,16,073.98 |

Bitbns | NEAR/INR | ₹ 149 | --- | ₹ 149 | ₹ 149 | N/A |

Flitpay | NEAR/INR | ₹ 97.09 | -5.37% | ₹ 102.79 | ₹ 96.805 | ₹ 12,43,515.41 |

Giottus | NEAR/INR | ₹ 98.2 | --- | ₹ 98.2 | ₹ 98.2 | N/A |

Unocoin | NEAR/INR | ₹ 130 | --- | ₹ 130 | ₹ 130 | ₹ 14,950.98 |

Zebpay | NEAR/INR | ₹ 220 | --- | ₹ 252 | ₹ 220 | ₹ 1,08,508.88 |

NEAR News

About NEAR Protocol

About NEAR Protocol

NEAR Protocol is a layer-one blockchain designed as a community-driven cloud computing platform, addressing common challenges faced by other blockchains, such as slow transaction speeds, low throughput, and poor interoperability. These improvements create an ideal environment for decentralized applications (DApps), offering a platform that is both developer- and user-friendly. For example, NEAR uses human-readable account names, unlike the complex cryptographic wallet addresses found on Ethereum. Additionally, NEAR introduces innovative solutions to scaling issues and features its own consensus mechanism called "Doomslug."

NEAR Protocol is developed by the NEAR Collective, a community dedicated to updating the initial code and continuously improving the ecosystem. The project's goal is to create a platform that is "secure enough to manage high-value assets like money or identity and performant enough to be useful for everyday people."

Notable projects built on NEAR Protocol include Flux, a protocol that allows developers to create markets based on assets, commodities, and real-world events, and Mintbase, an NFT minting

Similar Coins

Trending

NEAR Price Live Data

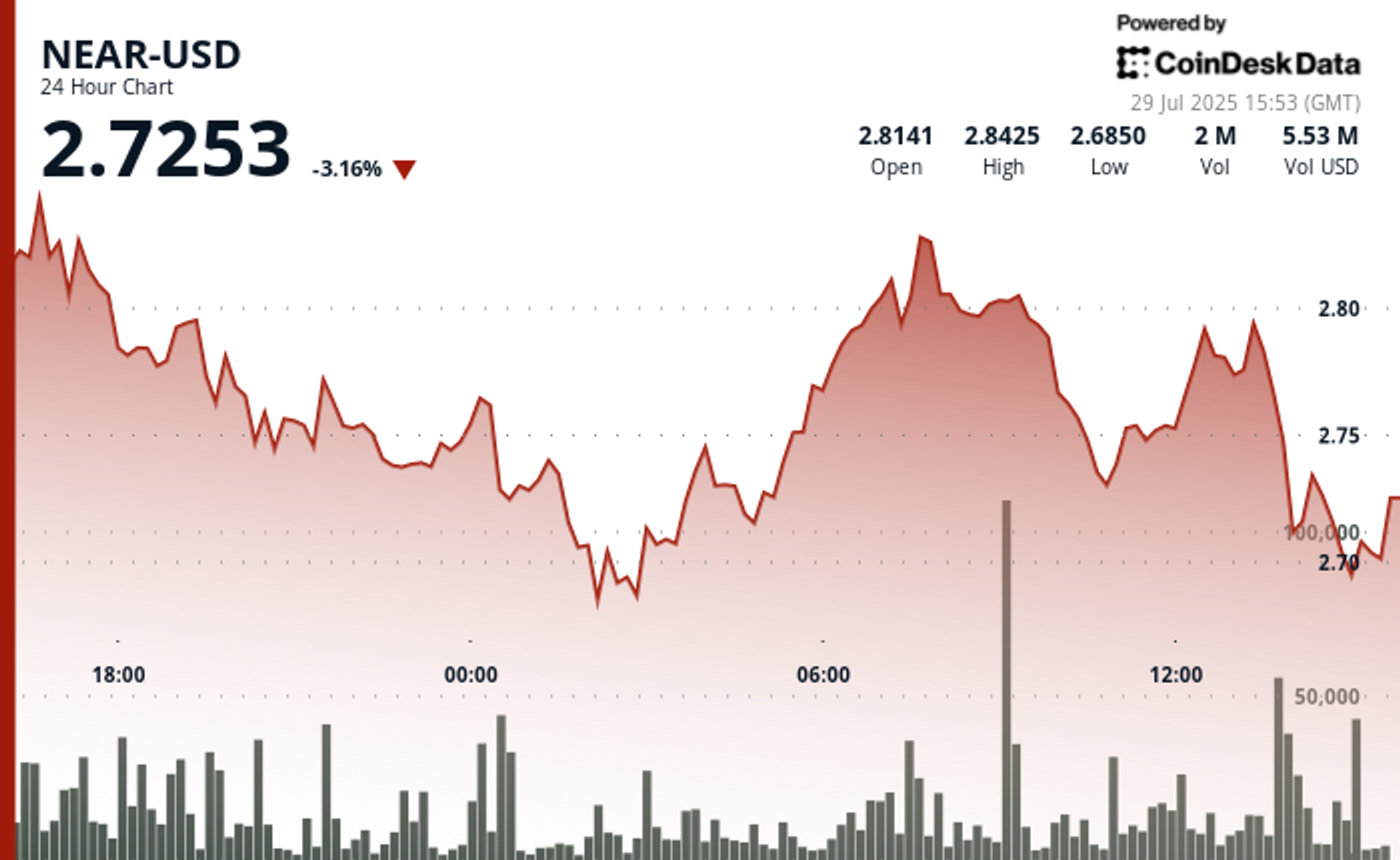

The live NEAR Protocol price today in INR is ₹ 97.292 , with a 24-hour trading volume of ₹ 1677152.36 . Crypshots updates this NEAR to INR price in real-time. The current NEAR Protocol price reflects a -5.05% change in the last 24 hours, with a market cap of ₹ 103.92G . There are 1.07G NEAR coins in circulation today.

If you want to buy NEAR Protocol at the current price, the top cryptocurrency exchanges for trading NEAR Protocol are Binance, Gate.io, CoinDCX, Flitpay, and Bybit. You can find other exchanges to buy NEAR Protocol on our crypto exchanges page.